It’s been hard to avoid the story of a company called GameStop (ticker symbol ‘GME’) this week. GameStop is a small video game and video game electronics company, and they’ve made headlines this week as some large hedge funds are—as of now, anyway—losing a very public and very expensive battle with retail investors. At least, that’s the story. We are getting a lot of questions about this saga over the last couple days so it seemed like a good idea to do a little write up….

As of the end of last week, GameStop was one of the most heavily shorted public companies. What does it mean for a company to be heavily shorted? What is “short selling,” anyway?

First of all, short selling is a totally legitimate and rarely nefarious thing. While it is typically large institutions and hedge funds that sell stocks short, their reasons for doing so are often in order to “hedge” their other bets and/or to reduce the risk of their portfolio. The easiest explanation of what it means to short a stock is that, in order to sell a stock short, I am selling shares of a company I do not actually own. How do I do this? I find someone who owns the shares and ask if I can borrow them. And I offer that person interest in order to borrow their shares for a period of time.

Why would anyone do this? Well, if I think the stock of company XYZ is overvalued, I may wish to try and profit from its eventual decline—I can do this, for a small (hopefully) fee by borrowing shares of XYZ at a reasonable interest rate, and sell those shares. In doing so I am also making the promise of buying back those shares at a later date; I don’t mind making this promise because I am confident the stock will fall and I can buy them back cheaper, making myself a profit. The process of buying back shares I’ve borrowed is referred to as “covering my shorts.”

What happens if I sell a stock short but then the stock goes up? Well, nothing, at first… I am responsible for paying the interest (or the “borrow”) on the shares I have borrowed, and maybe I’m not super worried if the stock goes against me for a little while. But if I am short a stock that starts going up a LOT—as GameStop has this week—I may have some real problems. Remember, I’ve promised to buy those shares back (cover) at a later date…

Depending on the size of my position, the scenario outlined above can become very serious very quickly. For instance, if a short position in GameStop made up 5% of my portfolio two weeks ago (when it was trading in the 30s), and then the stock went to $200 before I had the opportunity to cover any of those shares—I now have an enormous obligation on my books. Add to my problems that margin clerks at all the brokerage houses, in an effort to reduce THEIR potential liabilities, have just increased the rate of interest I have to pay on shares I’ve borrowed. But they didn’t raise the interest rate from 4% to 5%, they raised it to 100%. I am being figuratively choked by the margin clerks.

But that’s not all.

I have other problems now, because word is out on “the street” about my position (these things have a way of making the rounds). Other hedge funds and day traders are now aware that I have a massive short position in a stock that’s rallying—and they know I will have to cover my shorts ASAP. That means they know I have to buy the exact # of shares I have borrowed to sell short in the first place. And with a stock that is as thinly traded (very few outstanding shares relative to the # of shares that were sold short) as GameStop is/was, that means that the stock price is going to be pushed higher—maybe much higher—in the short term. Before crashing back down, that is….

This is what is known as a “short squeeze.”

If a person is willing to take on an obscene amount of risk, and get in and out within a matter of hours, there are profits to be made during a short squeeze by buying the stock before it ultimately comes crashing back down. The accompanying visual is a single hedge fund (or a couple hedge funds) being figuratively squeezed by these buyers, forcing shares higher and just inflicting maximum pain until they relent and cover (buy back) all the shares they’ve sold short.

Also getting attention as part of this story is a supposed group of rogue traders, active on Reddit message boards and using the Robinhood trading app, who have gotten involved in the GameStop short squeeze. This is where the story’s David vs Goliath element comes from—a band of small, retail traders “sticking it to the hedge fund man.”

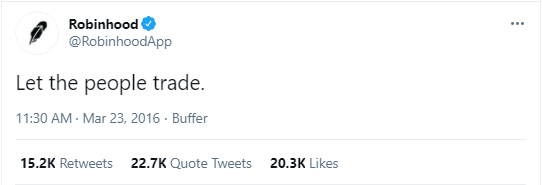

Because the dollars involved and the risks on both sides of the trade are now sufficiently enormous, Robinhood and other brokers have begun cracking down on trading in GameStop (this morning). And this begins the next part of the story, as retail traders are being shut out of executing trades they—theoretically—“should” be allowed to place. Consider that Robinhood was started in order to free the individual trader from the shackles of Wall Street brokerages….

Conversations are already underway among the regulators about whether any steps need to be taken in order to prevent this sort of thing in the future. And while the GameStop saga may be nothing more than an interesting story for those of us watching from the sidelines today, I think it’s very possible we will be hearing more about the fallout in the weeks to come….

* Argyle Capital Partners currently holds no positions (long or short) in GameStop on behalf of its clients.